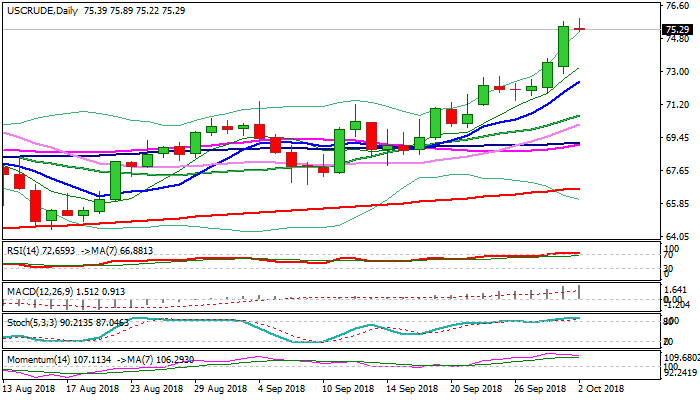

Bulls are expected to consolidate before continuing

WTI oil is consolidating within tight range under new four-year high at $75.89 on Tuesday, after strong rally last Thu-Fri resulted in weekly close above former 2018 high at $75.34, posted on 04 July.

Completion of $75.34/$64.43 corrective phase was bullish signal for continuation of broader uptrend from $26.04 (Feb 2016 low).

Strong bullish sentiment is driven by rising concerns about tighter global supply after US sanctions on Iran kick next month.

Meanwhile, bulls are expected to enter consolidative / corrective phase before continuing, with overbought daily RSI / slow stochastic and weakening momentum, supporting the notion.

Former lower top at $74.67 (10 July) marks solid support, violation of which would allow for dip towards $74.20 (Fibo 38.2% of $71.47/$75.89 upleg) and $73.68 (50% retracement), where extended dips should find ground to keep bulls intact.

Corrective action is seen as positioning for further upside and test of next key barriers at $76.35 (Fibo 61.8% of $107.45/$26.04 fall) and $76.53 (Fibo 138.2% expansion of current wave C of five-wave sequence from $64.43, 16 Aug low).

Res: 75.89; 76.35; 76.53; 77.00

Sup: 75.22; 74.67; 74.20; 73.68