Bulls are taking a breather but remain in play on hopes of less aggressive Fed

Spot gold holds firm bullish stance and consolidating under three-week high, posted after 3.2% rally on Friday (the biggest one-day rally since 24 June 2016), sparked by US labor data which raised hopes that the Fed may ease its aggressive stance in raising interest rates in the near future.

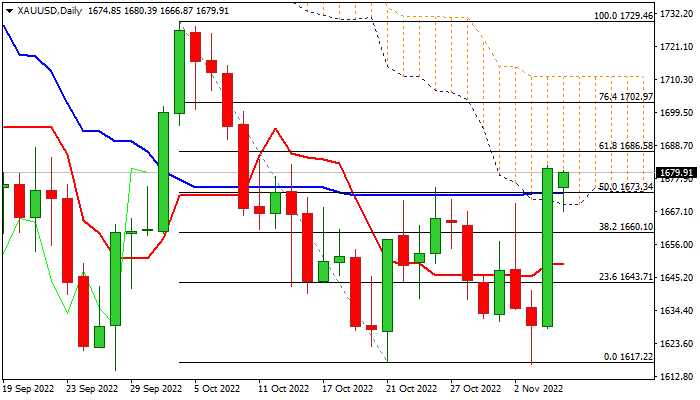

Fresh rally retraced over 50% of the $1729/$1617 bear-leg, leaving a double bottom ($1616/17), with penetration and close within thick daily cloud, adding to bullish signals.

Improved daily studies (strong bullish momentum / 10/20/30 DMA’s in positive setup) underpin recovery, which needs extension through $1680/$1686 pivots (55DMA / Fibo 61.8%) to confirm bullish stance and open way for attack at psychological $1700 barrier and daily cloud top ($1711).

Broken daily Kijun-sen / 50% retracement marks initial support at $1673, guarding more significant daily cloud base ($1669), loss of which would weaken near-term structure and risk deeper pullback.

Res: 1680; 1686; 1700; 1718

Sup: 1673; 1669; 1660; 1649