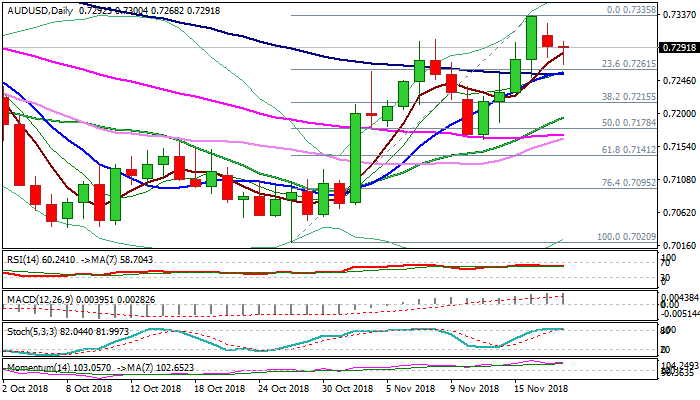

Bulls expected to remain in play while dips hold above daily cloud

The Australian dollar dipped further on Tuesday, following Monday’s close in red, the first after strong four-day rally, which signaled bulls might be running out of steam.

Today’s extension lower was triggered by lower stocks and hawkish tone from Fed’s Williams, but being short-lived so far.

Daily slow stochastic is reversing from overbought zone and could generate negative signal, but conflicted by fresh rise of bullish momentum and daily MA’s in full bullish setup.

Key near-term supports lay at 0.7256/53 (10 & 100SMA’s) which created bull-cross and 0.7247 (daily cloud top), with break here needed to weaken near-term structure and signal deeper pullback towards 0.7215 (Fibo 38.2% 0.7020/0.7335).

Conversely, overall bullish bias is expected to remain intact while 10/100SMA’s hold, for fresh extension of recovery phase from 0.7020 towards next target at 0.7381 (21 Aug high).

Res: 0.7300; 0.7325; 0.7335; 0.7381

Sup: 0.7268; 0.7256; 0.7247; 0.7215