Bulls face headwinds from weekly cloud base

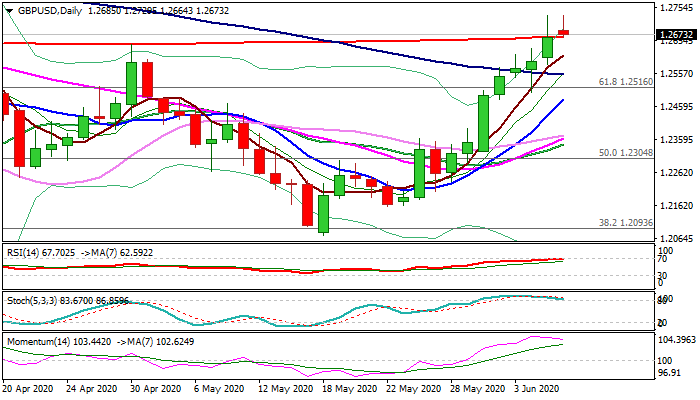

Cable probes above 200DMA (1.2668) in early Monday after Friday’s close was exactly at 200DMA, with the action being underpinned by big weekly bullish candle (the pair was up 2.8% last week).

On the other side, bulls face strong headwinds from weekly cloud base (1.2736) which may result in consolidation before fresh attempts higher.

Daily stochastic turned south in overbought territory, adding to signals of stall.

Dips should find ground above strong supports at 1.2553 (100DMA) and 1.2516 (broken Fibo 61.8% of 1.3199/1.1409) to remain in play, while break lower would signal pullback.

Today’s close above 200DMA would keep pressure on weekly cloud base, violation of which would expose strong resistances at 1.2924/38 (200WMA / weekly cloud top) and psychological 1.30 level.

Res: 1.2736; 1.2777; 1.2800; 1.2849

Sup: 1.2664; 1.2610; 1.2582; 1.2553