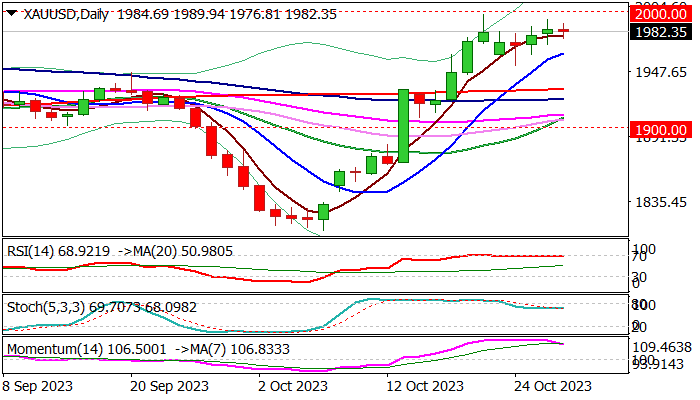

Bulls hold grip but may pause again under $2000 barrier

Gold keeps firm bullish tone and is on track for third weekly gain though the action remains capped just under psychological $2000 barrier.

Growing uncertainty over the conflict in the Middle East continues to fuel demand for safe-haven bullion, but signals that the Fed is going to keep high interest rates for some time, partially offset bullish impact.

In addition, $2000 level marks very significant barrier, with strong offers seen in this zone, however, a number of stops are parked above, and stronger breach would trigger acceleration higher.

South-turning aily indicators suggest that bulls may take a breather again, with end of week profit-taking to contribute and push the price lower.

Limited dips should be ideally contained by rising 10DMA / Fibo 23.6% of $1810/$1997 rally at $1963/50 zone, though deeper dips cannot be ruled out and should find ground above 200DMA ($1932) to keep bulls in play and offer better buying opportunities.

Res: 1989; 1993; 1997; 2000

Sup: 1976; 1963; 1953; 1947