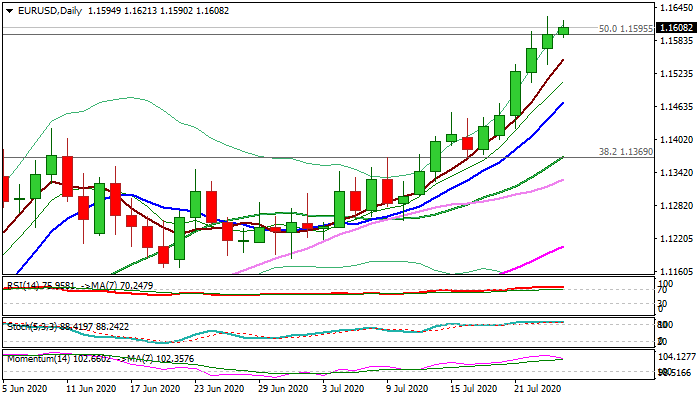

Bulls need weekly close above cracked Fibo barrier at 1.1595 for confirmation

The Euro is consolidating under new multi-month high (1.1627) on track for the fifth straight bullish weekly close and the biggest weekly gains since the last week of May.

The pair maintains strong bullish tone on weaker dollar and improved sentiment in the Eurozone, with better than expected German / EU PMI data in July, adding to positive mode.

This week’s probe above 1.1595 (50% retracement of 1.2555/1.0635 fall) was strong bullish signal which requires confirmation on weekly close above this level that would open way for extension towards next key obstacle at 1.1822 (Fibo 61.8% of 1.2555/1.0635).

On the other side, rising US/China tensions and new virus cases in the US may hurt risk sentiment and limit Euro’s gains, with overbought daily stochastic and RSI and fading bullish momentum adding to initial warnings.

Dips are expected to offer better buying opportunities while holding above rising 10DMA (1.1471).

Res: 1.1627; 1.1650; 1.1676; 1.1700

Sup: 1.1590; 1.1549; 1.1506; 1.1471