Cable hits new multi-month high on hotter than expected UK inflation

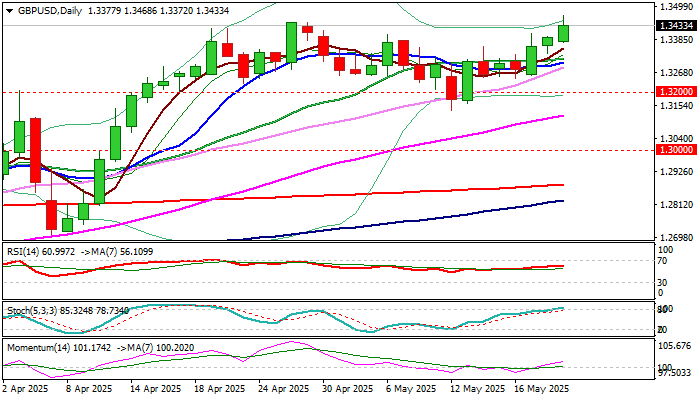

Cable eased to 1.3400 zone on Wednesday after fresh acceleration on hotter than expected UK inflation data probed through peaks of 2024 and 2025 (1.3434/1.3444) and hit the highest in over three years (1.3468).

Although gains were so far short-lived, as traders collected some profits on overbought signals, overall bullish structure is expected to remain intact.

Weakening dollar remains among main drivers of pound, with unexpectedly strong rise in consumer prices In April (the largest increase since 2022 / hit the highest in 15 months) adding pressure on the central bank for fewer rate cuts or delay in policy easing and making sterling more attractive.

Daily studies remain in full bullish setup (strengthening positive momentum / rising thick daily cloud continues to underpin the action / daily Tenkan/Kijun-sen about to complete bull-cross), though bulls may pause for consolidation due to overbought conditions and persisting headwinds that 1.3434/44 barriers produce.

Dips are likely to be limited and provide better levels for re-entering bullish market.

Res: 1.3468; 1.3500; 1.3557; 1.3600

Sup: 1.3400; 1.3360; 1.3305; 1.3250