Cable keeps firm tone, further gains likely after consolidation

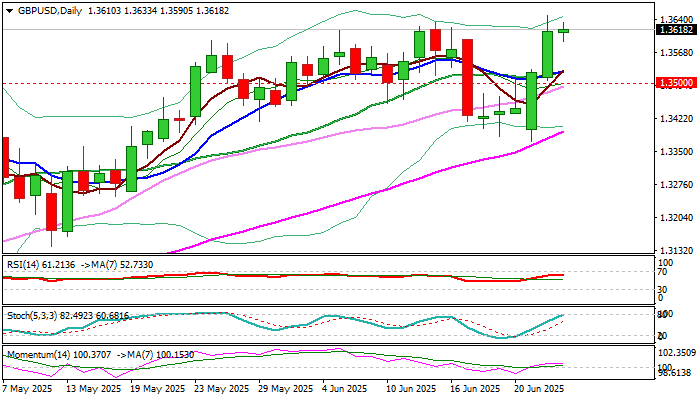

Cable remains steady and holds within a narrow consolidation just below new multi-month high (1.3648), posted on Tuesday, following strong bullish acceleration in past two days.

Revived risk appetite on growing confidence in still fragile ceasefire in the Middle East, continues to underpin near-term action, as markets await more details from Fed Powell’s second day of testimony to Senate Banking committee.

Powel mainly reiterated Fed’s stance on monetary policy on Tuesday, saying that the central bank will remain on seat and wait mode, focusing on inflation and impact from tariffs, with policy decisions to be based mainly on the latest economic reports.

Markets expect two rate cuts by the end of the year, with Fed’s hesitation to take more dovish stance being heavily criticized by President Trump who advocates for stronger rate cuts to boost investments and economic growth.

However, quite symmetrical Fed and BoE’s rate paths suggest that traders will be looking for signals more from economic data in coming months, but positive signal may come from Fed if the central bank opts for rate cut in July policy meeting (expectations for such action are so far low).

Daily studies are predominantly bullish and support the action for break higher that would look for targets at 1.3700 (round figure) and 1.3769 (50% retracement of 1.7189/1.0348 downtrend) in extension.

Immediate supports at 1.3590 zone, followed by 1.3530/00.

Res: 1.3648; 1.3700; 1.3769; 1.3800

Sup: 1.3590; 1.3530; 1.3500; 1.3453