Cable maintains positive tone after US jobs data but needs to clear key obstacles to signal bullish continuation

Cable keeps bullish stance and trading in green for the third straight day, with choppy trading under new one-week high (1.2530) seen after release of US jobs data.

Positive signals from NFP beat (June 4.8M vs 3M f/c) and significant drop in unemployment (June 11.1% vs 12.3% f/c) were partially offset by jobless claims slight miss (1.42M vs 1.35M f/c; continuing claims 19.29M vs 19M f/c) and drop in average earnings (June -1.2% vs 0.7% f/c), but overall solid data expected to boost risk sentiment.

Sterling could face headwinds from persisting divergence in talks between the EU and Britain on their future relationship after Brexit.

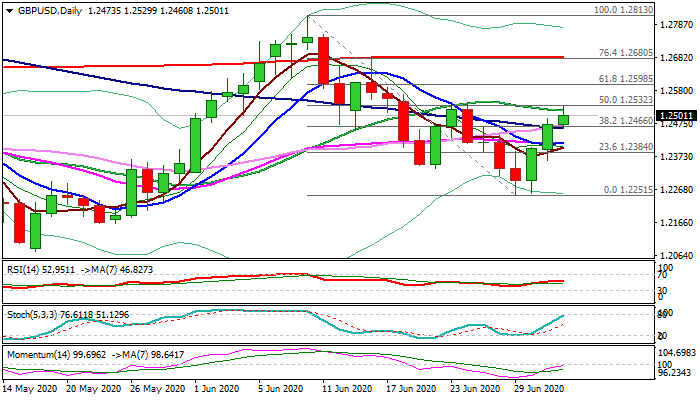

Bulls needs close above barriers at 1.2517/32 (20DMA / 50% retracement of 1.2819/1.2251) which were dented on today’s action, to signal extension and expose 1.2598 target (Fibo 61.8%).

Improving daily studies and reversal pattern on weekly chart support scenario, which requires today’s close above 1.2466 (broken Fibo 38.2% of 1.2813/1.2251 / 30DMA) to keep bulls intact.

Res: 1.2517; 1.2532; 1.2566; 1.2598

Sup: 1.2466; 1.2417; 1.2384; 1.2359