Cable – pullback finds footstep at key supports ahead of Fed / BOE rate decisions

Cable bounced from new three-week low (1.3415), hit after Tuesday’s 1.2% drop, boosted by weaker than expected UK inflation in May.

Weaker dollar also helps Wednesday’s recovery, as markets await Fed’s decision today and BOE’s monetary policy meeting (Thursday).

Both central banks are widely expected to hold rates this time, with market focus on signals from projections for the rest of the year.

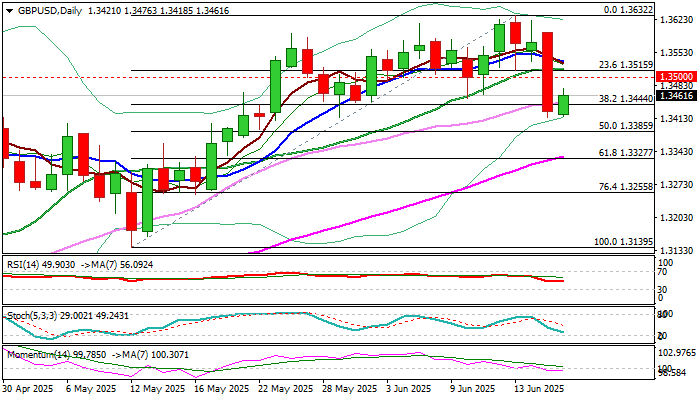

Near-term structure weakened after Tuesday’s close below 10/20DMA’s and probe through pivotal support at 1.3444 (Fibo 38.2% of 1.3195/1.3632, also the floor of recent range) though close below this level is needed to validate negative signal and open way for deeper pullback.

On the other hand, recovery needs to regain 1.3500/15 barriers (psychological / 20DMA / 50% retracement of 1.3632/1.3415) to sideline existing downside risk and shift focus to the upside (1.3550; 1.3595; 1.3616).

Res: 1.3515; 1.3550; 1.3595; 1.3616

Sup: 1.3415; 1.3400; 1.3377; 1.3321