Cable weakens on downbeat UK earnings data; inflation report in focus

Cable pulls back in European trading on Tuesday, erasing a good part of Monday’s 0.65% jump, pressured by weaker than expected UK pay growth data, which increases pressure on those advocating for another BoE rate hike.

Markets await release of UK Sep inflation report on Wednesday (6.5%y/y f/c vs 6.7% Aug and core 6.0% f/c vs 6.2% Aug),

September figure in line or below expectations will weigh further on hawkish rate view and keep sterling at the back foot.

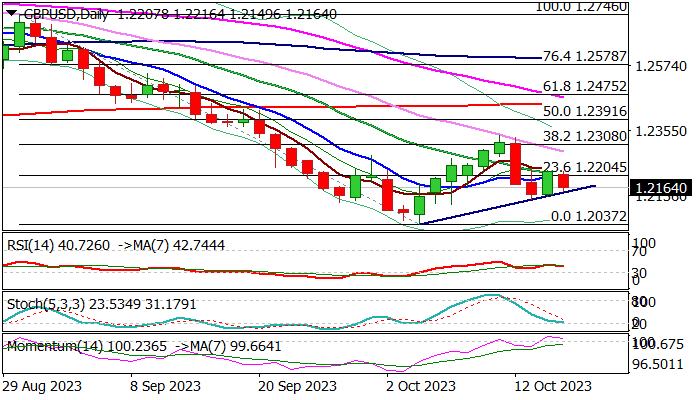

Fresh weakness pressures initial support at 1.2141 (bull-trendline off 1.2037 low) ahead of pivotal point at 1.2122 (Friday’s low), loss of which would signal further weakness and risk retest of Oct 4 low at 1.2037.

Converged 10/20DMA’s 1.2200/13) mark pivotal barrier, with sustained break here to sideline immediate downside threats and open way for fresh recovery.

Res: 1.2200; 1.2213; 1.2271; 1.2308

Sup: 1.2141; 1.2122; 1.2100; 1.2037