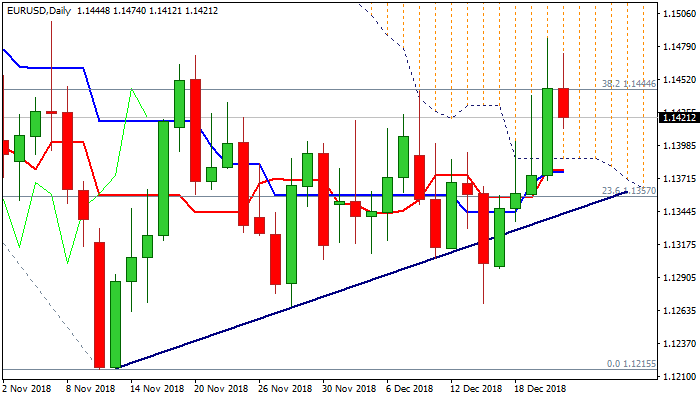

Close above cracked Fibo barrier at 1.1444 needed to confirm bulls

The Euro eases from new six-week high at 1.1485, posted after strong rally on Thursday, where bulls were capped by 100SMA and consolidating in the middle of thick daily cloud.

Yesterday’s close within the cloud was bullish signal after falling thick daily cloud capped several attempts, but fresh bulls failed to close above pivotal Fibo barrier at 1.1444 (38.2% of 1.1815/1.1215 descend), despite spike to 1.1485.

Profit-taking after the biggest one-day gains in Dec on Thursday could push the price lower, with momentum and slow stochastic turning south on daily chart and supporting scenario.

Strong supports at 1.1396/88 (55SMA / daily cloud base) are expected to contain extended dips and keep fresh bulls in play.

The pair is on track for strong weekly close and forming weekly bullish engulfing, which could be another supportive factor.

Bulls need close above 1.1444 Fibo barrier to generate fresh bullish signal for extension through 100SMA and test of next key barrier at 1.1515 (50% of 1.1815/1.1215 / daily cloud top) break of which would signal reversal.

Conversely, return and weekly close below daily cloud would weaken near-term structure and signal an end of recovery phase.

With no releases from the EU, focus turns towards a batch of key US data, due later today (GDP; Retail Sales; Durable Goods Orders) which would provide fresh signals.

Res: 1.1444; 1.1485; 1.1499; 1.1515

Sup: 1.1412; 1.1396; 1.1388; 1.1350