Copper extends steep fall, sparked by modification of Trump’s tariff plan for metal’s imports

Copper remains firmly in red on Thursday after falling over 18% previous day and extends weakness to the lowest in almost four months.

Copper price collapsed from the zone near new record high after President Trump surprised markets by excluding a number of copper products from initial 50% tariff list, leaving copper pipes and wiring.

Strong market reaction, in which metal’s price erased gains from previous months, reflects the magnitude of shock produced by Trump’s latest decision.

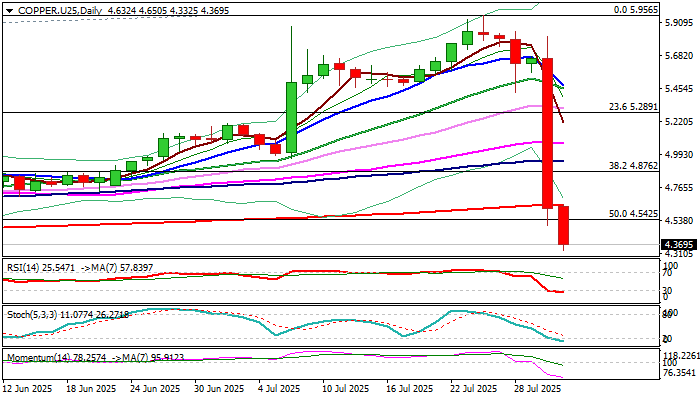

Copper is also on track for a record weekly loss and generated strong negative signal from large monthly bearish candle with long upper shadow, which also completed bearish engulfing pattern.

Technical picture on daily chart from firmly bullish to increasingly bearish within a day, opening prospects for further easing.

Although daily studies are deeply oversold, indicators are still heading south and so far lacking any signal of correction, which should be anticipated in coming sessions after euphoria fades.

Wednesday’s close below 200DMA (4.6399) and today’s dip and likely close below 50% retracement of July 2022 / July 2025, 3.1285/5.9565, uptrend (4.5425) contributes to negative near-term outlook.

Bears found temporary footstep at 100WMA (4.3128) but keep in focus next targets at 4.2088 (Fibo 61.8%) and 4.1541 (200WMA).

Broken 200DMA (4.6399) reverted to initial resistance, while broken daily cloud top (4.8961) should cap extended upticks to keep fresh bears in play.

Res: 4.5425; 4.6399; 4.7068; 4.8762

Sup: 4.3128; 4.2088; 4.1541; 4.1000