Copper price fell to nearly two-week low on renewed concerns about weaker demand

Copper price fell further on Monday, extending pullback from last week’s recovery high ($2.3929) into third straight day.

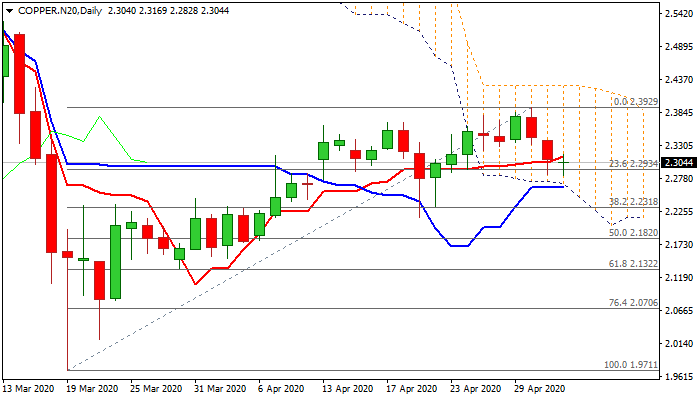

Future contract for July’s delivery fell to the lowest in nearly two weeks ($2.2828) on Monday, but stays for now above cracked initial support at $2.2834 (Fibo 23.6% of $1.9711/$2.3929) and more significant daily cloud base ($2.2696) and daily Kijun-sen ($2.2634).

Copper prices came under pressure after US President Trump’s renewed threats of new tariffs on China’s goods that soured sentiment on rising fears about shrinking demand in top consumer China after some countries already started to ease lockdown restrictions.

Bearishly aligned daily studies support scenario of further weakness which requires confirmation on break and close below daily cloud base / Kijun-sen.

Deeper pullback would look for test of next key support at $2.2318 (Fibo 38.2% of $1.9711/$2.3929), loss of which would generate initial reversal signal.

On the other side, immediate downside threats will be reduced if the price remains above $2.2696/34 pivots, however, sideways mode could be expected as long as the price holds below upper pivot at $2.3300 (4-hr 20MA).

Res: 2.3169; 2.3270; 2.3300; 2.3395

Sup: 2.2828; 2.2696; 2.2634; 2.2318