Correction on oversold studies to precede fresh weakness

The pair bounces from one-month low on Tuesday, as selloff in global stock markets eased, reducing safe-haven demand.

Japanese yen advanced in past two weeks on strong fall in stock markets as well as uncertainty over US/China trade war, which boosted its safe-haven appeal.

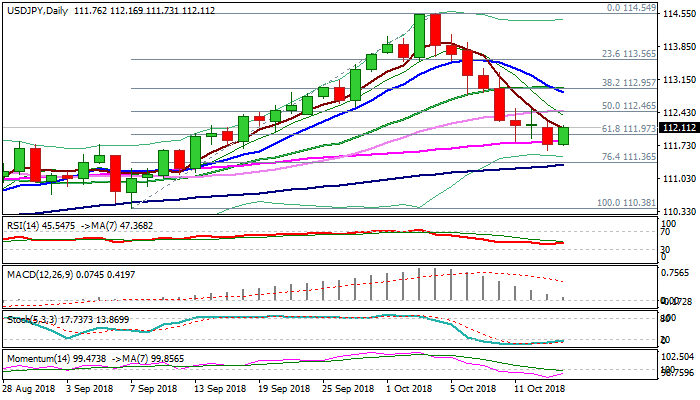

Bounce comes after larger bears were contained by rising 55SMA and strongly oversold daily studies warned of correction.

Reversing slow stochastic and momentum support the action, but overall structure remains firmly bearish and favors further weakness after correction.

Repeated close below Fibo support at 111.97 (61.8% of 110.38/114.54) and final break below 55SMA are needed to signal bearish continuation towards 111.32/00 (100SMA / round-figure).

Monday’s high at 112.23 marks initial resistance with extended upticks to be ideally capped by 30SMA (112.45).

Lift above 20SMA (112.95) would neutralize bears and signal reversal.

Res: 112.23; 112.45; 112.95; 113.08

Sup: 111.82; 111.62; 111.32; 111.00