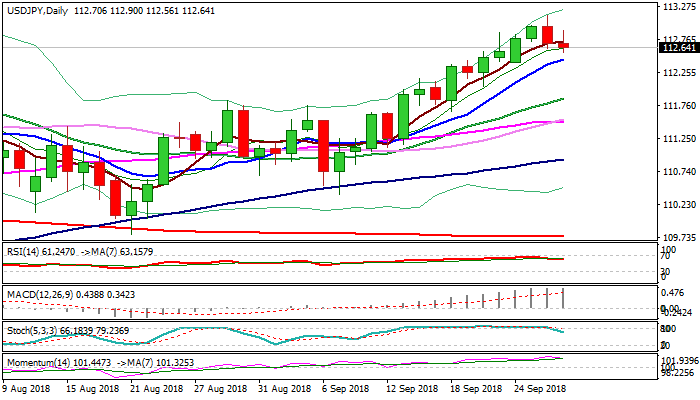

Corrective easing needs to hold above 10SMA to keep bulls intact

The pair eases further on Thursday, following previous day’s close in red after bulls stalled ticks ahead of key barrier at 113.17 (19 July high).

Formation of bearish outside day was negative signal for deeper pullback, despite positive impact on dollar from hawkish Fed on Wednesday.

Overall bulls are expected to remain intact for renewed attack at key 113.17/30 barriers if rising 10SMA (112.45) contains pullback.

Sustained break above 113.17/30 pivots (19 July high / Fibo 61.8% of 118.66/104.63) would generate strong bullish signal for extension of recovery phase from 104.63 (2018 low).

Conversely, close below 10SMA would risk deeper pullback and expose supports at 112.08 (Fibo 38.2% of 110.38/113.13) and 111.86 (rising 20SMA).

After Fed announced its decision, focus turns again towards US/China trade conflict which is one of key market drivers.

Res: 112.90; 113.17; 113.30; 113.75

Sup: 112.56; 112.46; 112.08; 111.86