Crude oil price rises further as positive moves in US-China trade talks improve the sentiment

WTI oil price jumped over $2 on Monday following success of US-China trade talks over the weekend that eased tensions and signaled that world’s two largest oil consumers are on the way to resolve their trade conflict.

The markets welcomed positive move that significantly brightened the demand outlook and further lifted oil price.

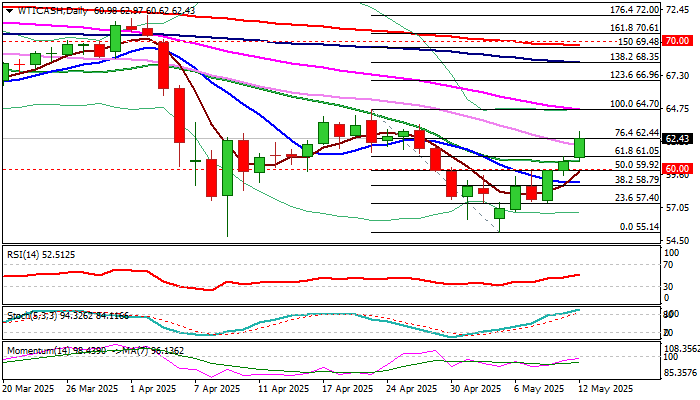

The WTI contract resumed strong rally of the last week (up almost 8%) on Monday and hit the highest in two weeks, marking retracement of over 76.4% of $64.70/$55.14 bear leg.

Bulls focus target at $63.55 (Apr 28 high) the last obstacle en-route to $64.70 breakpoint (Apr 24 high), violation of which to generate reversal signal on completion of daily bullish failure swing pattern.

However, a pause in current rally (due to overbought conditions and 14-d momentum indicator being still in negative territory) may precede fresh push higher, with shallow dips to ideally find ground at $61.00 zone and offer better levels to re-enter bullish market.

Only loss $60 pivot, which previously marked strong barrier and now reverted to solid support, would sideline bulls.

Res: 62.97; 63.55; 64.70; 65.00

Sup: 61.90; 61.05; 60.71; 60.00