Dollar drops across the board on the latest tariff threats

Fresh migration into safety after latest signals from President Trump about additional tariffs on a number of EU countries weakened the sentiment and increased pressure on the US dollar.

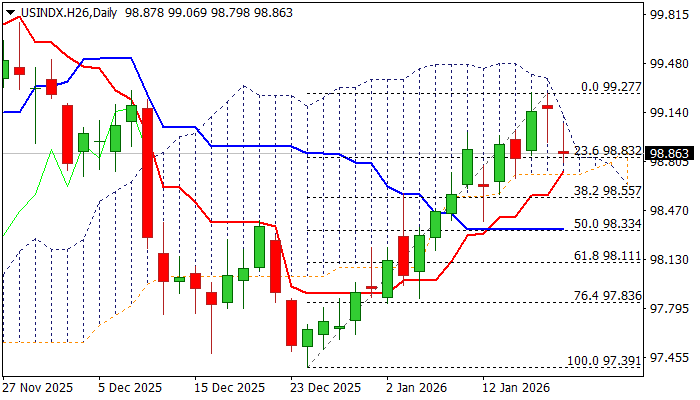

The dollar index opened about $40 lower on Monday and fell to five-day low, with potential for deeper correction of $97.39/$99.27 upleg.

Fading bullish momentum and south heading RSI and Stochastic on daily chart (after Stochastics’ bearish divergence signaled stall of the latest rally) contribute to signals of further easing, along with double bull-trap (at $99.20 Fibo resistance) though fresh weakness needs to clear pivotal supports at $98.83/73 zone (Fibo 23.6% of $97.39/$99.27 / daily Tenkan-sen / cloud base) to validate signal and spark fresh acceleration lower (Fibo supports 38.2%; 50% and 61.8% at $98.55; $98.33 and $98.11 respectively).

Fragile political situation with threats of further escalation on EU’s response to Trump’s threats, contributes to dollar’s negative performance, however strong positive technical signals from diverging daily Tenkan/Kijun-sen after forming a bull-cross and converging 100/200DMAs in attempt to for golden-cross, may partially offset bears.

Res: 98.79; 99.00; 99.30; 99.63

Sup: 98.73; 98.55; 98.33; 98.11