Dollar index approaches 100 barrier in strong post-Fed rally

The dollar index hit three-month high on steep post-Fed rally, after unexpectedly hawkish stance of chief Powell faded recent risk appetite and shifted investments into safety of greenback.

Drop in bets for Fed’s December rate cut, after central bank’s hawkish cut last Wednesday, still unclear results of Trump – Xi meeting on Thursday (despite Trump’s super optimistic media comments) added support to the dollar.

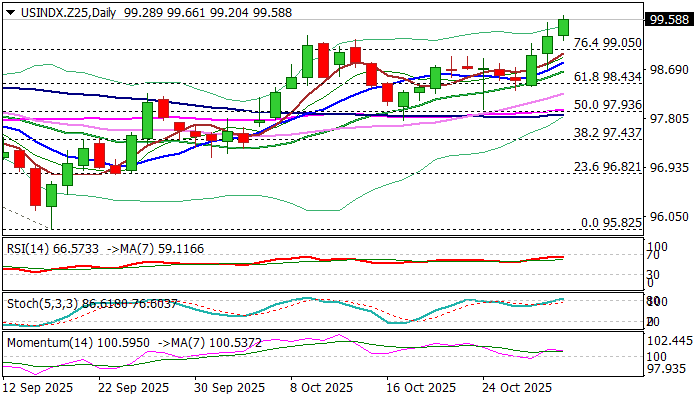

Fresh acceleration that extends into third straight day, broke above previous top (99.30) and nears psychological 100 barrier (also top of Aug 1), also bringing in focus falling 200DMA (100.25).

The index is on track for the second weekly gain and gains of over 2% in October that adds to positive outlook, as daily studies remain in full bullish configuration.

However, overbought conditions and profit taking at the end of the week / month, may slow the rally, with dips to be ideally contained at 99.00/98.80 zone (broken Fibo 76.4% / rising Tenkan-sen) and offer better levels to re-enter bullish market.

Res: 100.00; 100.25; 100.40; 100.74

Sup: 99.30; 99.05; 98.80; 98.40