Dollar index to remain constructive above 100 support

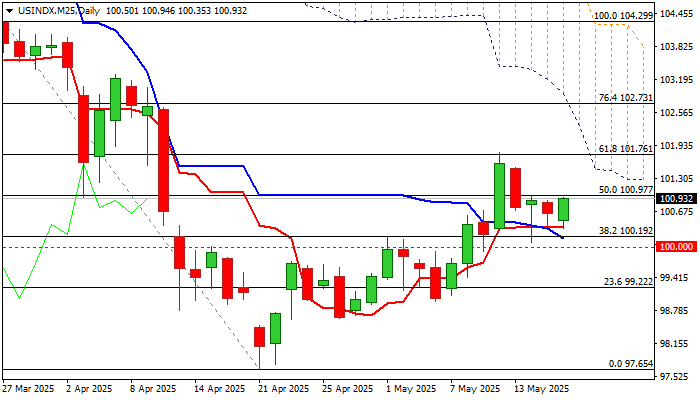

The dollar index holds within a narrow range on Friday, some hundred pips under new one month high (101.76) but keeps bullish bias above 100 level.

The dollar is on track for the second consecutive close above psychological 100 support and for the fourth straight weekly gain, although long upper shadow on this week’s candle warns of growing offers, as the latest weaker than expected US economic data add to hopes of more Fed rate cuts and partially offset positive impact from signals of an end of US-China trade war.

Technical studies on daily chart are mixed and lack clearer direction signal, predominantly bearish structure on weekly chart (strong negative momentum / MA’s in firm bearish setup with multiple bear crosses) suggest that recovery from 2025 low (97.65) may run out of steam.

Markets will be mainly focusing on Fed’s action in coming months, though the outlook is still mixed, as weaker economic data and lower inflation in April work in favor of policy easing, but economists warn that full impact of US tariffs is still to show and may boost inflation and again complicate central bank’ position.

Former pivotal barriers at 100.19/00 (broken Fibo 38.2% of 104.29/97.65 / psychological) reverted to solid supports which should keep the downside protected for renewed attempts higher, with violation of 101.80 barrier ((last Monday’s peak / Fibo 61.8% of 104.29/97.65) to generate initial signal of bullish continuation and expose targets at 102.73/93 (Fibo 76.4% / base of falling daily cloud).

Res: 101.23; 101.76; 102.00; 102.73

Sup: 100.37; 100.00; 99.22; 98.95