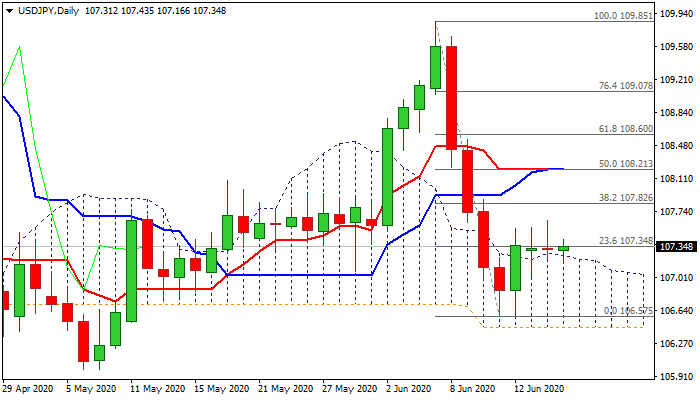

Double-Doji signal indecision as recovery lacked momentum after emerging above daily cloud

The pair extends directionless mode into third straight day, remaining above daily cloud top (107.25) but double-Doji candles (Mon/Tue) signal strong indecision.

Near-term picture improved after last week’s steep fall was contained by daily cloud and Friday’s bullish engulfing signaled reversal, but recovery was so far limited and lacking momentum to extend.

The dollar was supported by risk aversion on fears of coronavirus second wave and surprise surge in US retail sales, but positive reaction was not as expected.

Technical studies send mixed signals as near-term action remains supported by daily cloud, but a cluster of daily MA’s in bearish setup weighs, while momentum and RSI are flat.

Recovery needs break above 107.61 (converged 30/55DMA’s) and more important 107.82/84 barriers (Fibo 38.2% of 109.85/106.57 / converged 10/20DMA’s) break of which would generate fresh bullish signal.

Conversely, return and close below daily cloud top would weaken near-term structure and expose key supports at 106.57/44 (11 June low / daily cloud base).

Res: 107.61; 107.84; 108.12; 108.41

Sup: 107.25; 107.00; 106.57; 106.44