Dow Jones remains firmly in red, on track for weekly drop of over 5%

Dow was down 4.8% in past two days, strongly pressured by risk aversion as markets fear of deeper crisis that US tariffs and counter measures could cause on global economy.

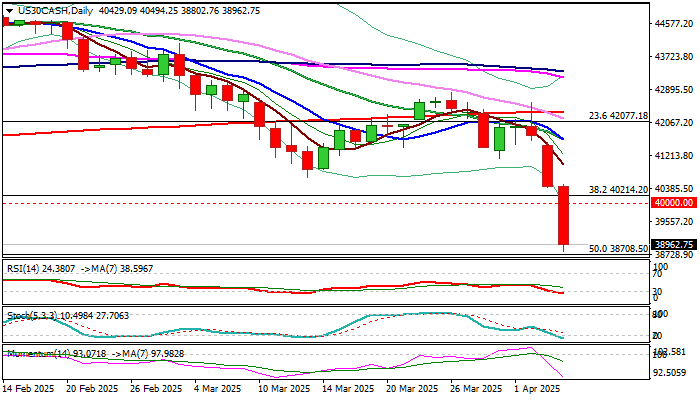

From the technical point of view, daily studies are in full bearish setup, while weekly studies are weakening and contribute to negative outlook.

Break of important supports at 40214 and 40000 (Fibo 38.2% of 32328/45088 / psychological) and attempts to register weekly close below these levels, would generate strong bearish signal for deeper drop.

Completion of a double-top pattern on weekly chart has been confirmed by the latest weakness that adds to downside risk.

Immediate target lays at 38708 (50% retracement) with break here to expose 37624 (weekly Ichimoku cloud base) and 37202 (Fibo 61.8% retracement).

Strong resistances at 40000/40700 zone (broken supports / former low of Mar 13) should ideally cap upticks.