Dow Jones surges as trade deal boosts risk appetite

Dow is trading at the highest in nearly six weeks at the start of the US session on Monday, after it opened with a gap-higher in Asia and advanced around 1.3% since then.

The latest trade deal between US and China provided strong relief to the markets and boosted risk sentiment, after highly volatile conditions in past few weeks, driven by fears of global trade war and all negative consequences it may cause.

The sentiment started to improve after the US made agreements with a number of countries, including Japan, South Korea, India and United Kingdom) with deal with the biggest trading partner and the second largest world economy – China, boosting prospects for stronger economic growth.

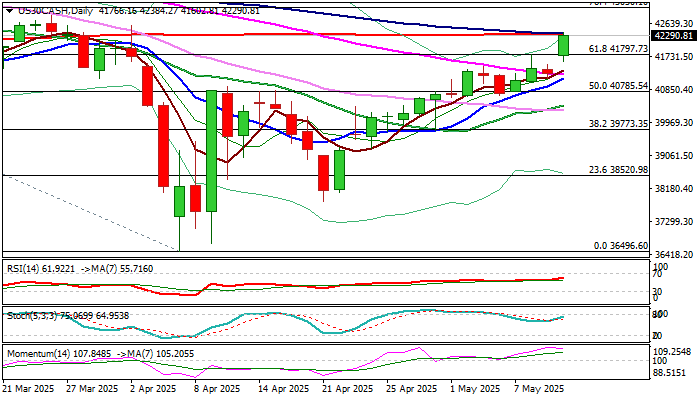

The Dow Jones entered the fourth consecutive week of gains and emerged above weekly cloud top (42096), with the action on daily chart testing converged 100/200DMA’s (42356).

Bulls may show hesitation at this point as fading bullish momentum indicates, though strong positive sentiment is expected to keep bulls firmly in play, with shallow dips rather to mark positioning for fresh push higher than to signal correction.

Broken Fibo 61.8% of 45024/36496 (41797) and session low (41600) offer good supports where dips should find firm ground, guarding supports at 41257 (55DMA) and 41141 (10DMA).

Res: 42356; 42570; 42834; 43050

Sup: 41960; 41600; 41257; 41141