EURGBP falls to three-week low in extension of steep descend

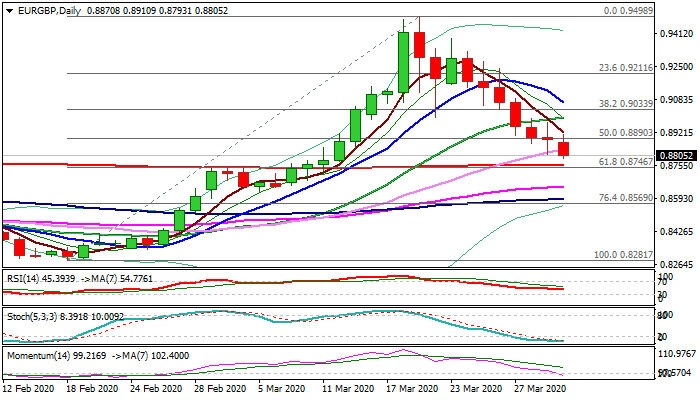

The cross extends weakness into seventh straight day and hits new three-week low just below 0.88 handle on Wednesday.

Momentum indicator on daily chart broke into negative territory and supports further weakness as the single currency remains under pressure on strengthening dollar and on lack of agreement between EU countries on common debt that would help in fighting coronavirus negative impact on bloc’s economy.

Bears eye key supports at 0.8755/46 (200DMA / Fibo 61.8% of 0.8281/0.9498 rally), clear break of which is expected to generate strong bearish signal for extension towards targets at 0.8651 (55DMA); 0.8588 (100DMA) and 0.8569 (Fibo 76.4%).

Falling 5DMA (0.8920) which tracks the fall for one week offers initial barrier, with 20DMA (0.8993) which is turning sideways, expected to cap upticks and maintain bearish bias.

Res: 0.8890; 0.8920; 0.8993; 0.9033

Sup: 0.8793; 0.8755; 0.8746; 0.8651