EURGBP hits the highest in over two years as shift in BoE policy expectations and UK budget concerns weigh on sterling

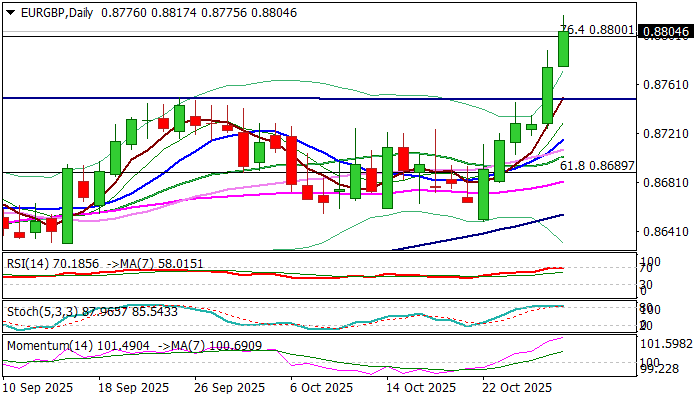

EURGBP hit new 2025 high and held at the highest levels since May 2023 on Wednesday.

Steep upleg from Oct 22 extends into sixth straight day, as sterling came under increased pressure from shift in monetary policy expectations which sees BoE rate cut as early as November (the MPC meets next week).

The latest economic data showed that inflation held steady last month, earnings grew at the slowest pace in almost three years, and unemployment ticked higher, setting stage for policy easing, against previous forecasts for no rate cuts this year.

Growing UK budget concerns also add to pound’s recent weak performance.

Firmly bullish daily studies support the action, though overbought stochastic and RSI touching the borderline of overbought territory, warning that bulls might be losing traction that contributes to scenario of profit taking after strong rally.

Overall picture remains bullish and suggests that limited dips would be positioning for fresh push higher.

Former tops / trendline at 0.8750/40 and rising 10DMA / broken Fibo 61.8% (0.8700 zone) offer solid supports which should ideally contain dips.

Res: 0.8817; 0.8835; 0.8875; 0.8900

Sup: 0.8750; 0.8700; 0.8650; 0.8631