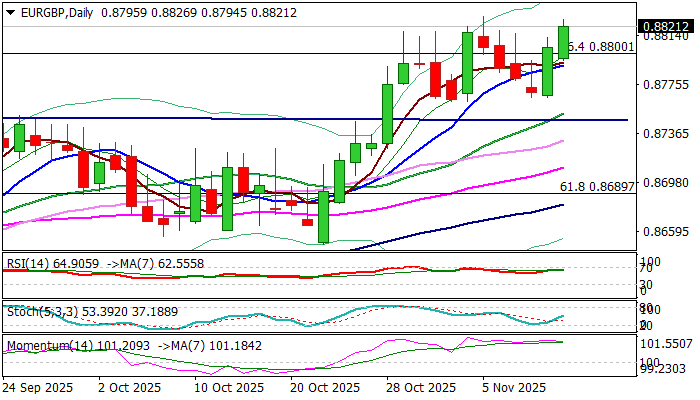

EURGBP on track to resume uptrend after a shallow correction

Fresh bullish acceleration from new higher base at 0.8765, extends into second consecutive day and came just ticks ahead of 2025 peak (0.8829, posted last week) on track to fully reverse four-day 0.8829/0.8765 corrective leg and to resume broader uptrend.

Political crisis in the UK and budget uncertainty add pressure on sterling, along with cooling labor market (unemployment in UK rose to four-year high) contributing to expectations for BOE rate cut.

Bullish continuation signal is expected on firm break of 0.8829 top that would open way towards 0.8875 (Apr 23 high), 0.8900 (round-figure) and 0.8925 (March 7).

Solid supports lay at 0.8800/0.8790 (broken Fibo 76.4% / rising 10DMA) followed by a higher base at 0.8765, above which extended dips should find support to keep bulls in play.

Res: 0.8875; 0.8900; 0.8925; 0.8978

Sup: 0.8800; 0.8790; 0.8765; 0.8750