Euro eases on weak German data, profit-taking

The Euro dips below 1.21 mark in European trading on Friday, pressured by greater than expected German economy’s contraction in Q1, and profit-taking ahead of May holidays in China and Japan, which are expected to reduce the activity and weigh on volatility.

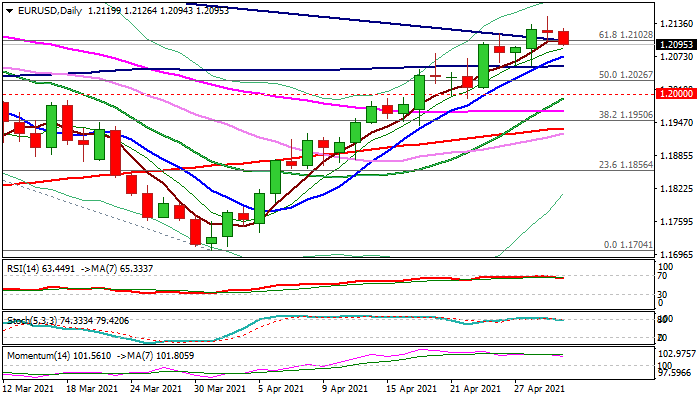

Fresh weakness emerges after the action on Thursday hit new two-month high but ended in Doji candle, signaling indecision, while overbought daily studies contributed to today’s drop.

Larger uptrend from 1.1704 (2021 low posted on Mar 31) remains intact and dips are expected to mark a healthy correction before resuming.

Sideways-moving 100DMA (1.2053), above which a higher base was formed earlier this week, marks solid support which is expected to ideally contain dips and keep bullish structure intact.

Caution on break here that would lead to deeper correction and put bulls on hold, as negative signals are developing on weekly chart.

Weekly stochastic is strongly overbought, momentum remains in the negative territory, while the pair is on track to end weekly action in Doji candle and threaten of closing below bear-trendline off 1.2349 (2021 high).

However, strong advance in April (the biggest one month gains since July 2020) and formation om monthly bullish engulfing may partially offset negative signals.

Res: 1.2102; 1.2126; 1.2149; 1.2178

Sup: 1.2072; 1.2053; 1.2026; 1.2000