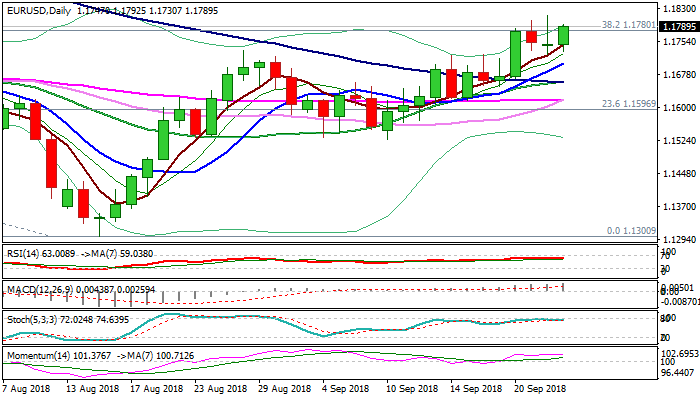

Euro holds near-term bullish bias but needs close above 1.1780/1.1800 to signal continuation

The Euro stands at the front foot in early American session on Tuesday and probes again above cracked Fibo barrier at 1.1780 (38.2% of 1.2555/1.1300).

Recent attempts higher registered thre consecutive failures to clearly break this barrier and bulls were strongly rejected on probe above 1.1800 on Monday, but limited dips and subsequent bounce (today) kept near-term bullish bias.

Bullish configuration of daily indicators supports but sideways-moving momentum and bear-cross on slow stochastic warns that bulls may run out of steam again.

The pair looks for catalyst to break out of congestion which extends into fourth straight day, with FOMC rate decision on Wednesday, expected to provide stronger direction signal.

Bullish scenario requires close above 1.1780 and 1.1800 hurdles to generate bullish signal for for attack at.1848 (14 June high) and possible extension towards 1.1928 (50% of 1.2555/1.1300 descend).

Conversely, violation of congestion floor at 1.1724 (Monday’s low) would be initial negative signal, which requires confirmation on close below rising 10SMA (1.1702).

Res: 1.1800; 1.1815; 1.1848; 1.1900

Sup: 1.1724; 1.1700; 1.1670; 1.1659