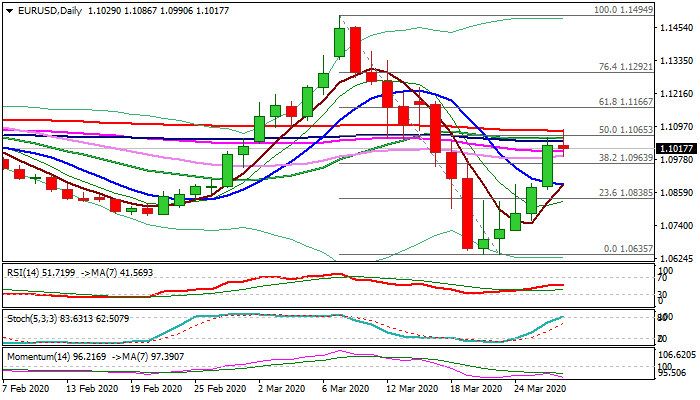

Euro is consolidating between daily cloud top and 200DMA

The Euro dips below 1.10 handle on Friday after earlier upticks were capped by 200DMA (1.1081).

The pair rallied 1.3% on Thursday, making the biggest daily advance since 12 Jan 2018 and generated bullish signal on close above daily cloud.

Thick cloud now offers solid support and repeated daily close above cloud top is needed to keep bulls intact.

On the other side, warning signals come from Thursday’s failure to break above a cluster of daily MA’s in 1.1043/81 zone (100/20/200); weakening momentum and overbought stochastic.

This may keep bulls on hold, despite Thursday’s large bullish candle and daily cloud underpin the action.

Deeper dips should be contained above broken key Fibo barrier at 1.10963 (38.2% of 1.1494/1.0635), to maintain bullish bias.

Ability to hold above daily cloud would keep immediate focus at the upside, with close above 200DMA to generate bullish signal for extension towards next key Fibo level at 1.1166 (61.8% of 1.1494/1.0635)

Res: 1.1043; 1.1065; 1.1081; 1.1100

Sup: 1.1008; 1.0990; 1.0963; 1.0906