EURUSD advances further in extended post-Fed rally

The Euro remains firm and rises to the highest in seven weeks on Thursday, in extension of Wednesday’s 0.6% advance, mainly seen in post-Fed acceleration.

The single currency benefited from Fed rate cut and more hawkish than expected monetary policy projections for 2026, which further deflated the US dollar.

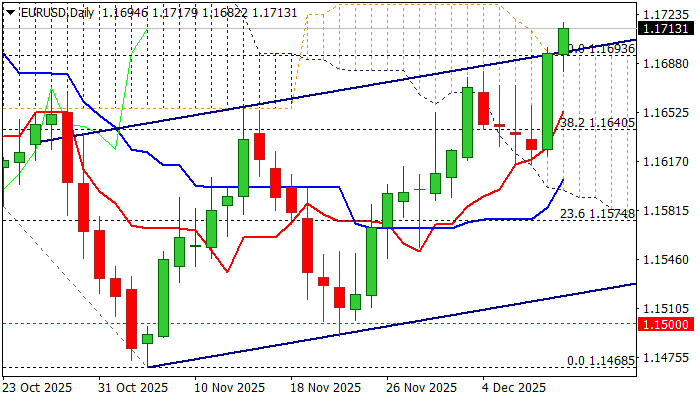

Rise above significant barriers at 1.1700 zone (psychological / near 50% retracement of 1.1918/1.1468 / daily Ichimoku cloud top) generated bullish signal which need to be verified on sustained break above these levels and keep bullish structure for attack at 1.1746 (Fibo 61.8%) and potential extension towards 1.1800.

Daily studies in full bullish setup (daily Tenkan/Kijun-sen in steep ascend and diverging after formation of bull-cross /strong bullish momentum, with thick daily cloud underpinning the action) contribute to positive fundamentals and keep the door open for further advance.

Broken top of daily Ichimoku cloud (1.1693, also broken bull-channel upper boundary) reverted to strong support, which should contain dips and keep fresh bulls in play.

Res: 1.1746; 1.1778; 1.1812; 1.1830

Sup: 1.1693; 1.1680; 1.1653; 1.1603