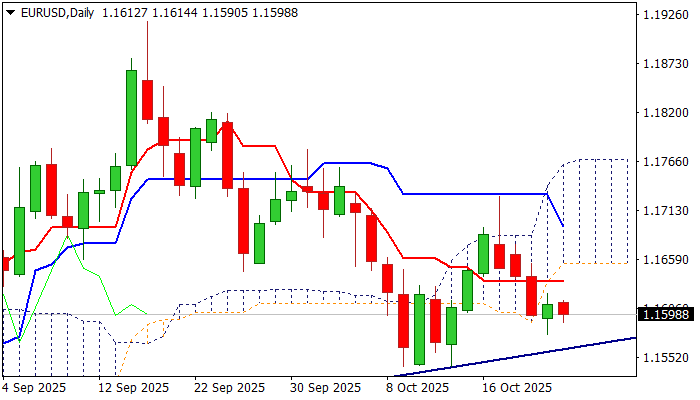

EURUSD – bearish bias below daily cloud

The Euro eased on Thursday morning and signal that near-term bears off 1.1728 (Oct 17 lower top) are regaining control after limited and short-lived recovery attempts on Wednesday.

The price has established below relatively thick daily Ichimoku cloud which continues to weigh on near-term action, after Wednesday’s bounce attempts stalled under initial barriers at 1.1631/35 (Fibo 23.6% of 1.1918/1.1542 / daily Tenkan-sen) guarding cloud base (1.1655).

Negative daily studies (14-d momentum moves deeper in the negative territory, RSI at 42 and MA’s in full bearish setup) contribute to scenario of probe through trendline support (1.1566) and potential retest of daily higher base at 1.1542 (formed in past two weeks).

Firm break here would generate stronger negative signals (bearish continuation on completion of bearish failure swing) and open way towards 1.1400 zone (higher base of late July / early Aug).

Res: 1.1635; 1.1655; 1.1686; 1.1700

Sup: 1.1566; 1.1542; 1.1500; 1.1391