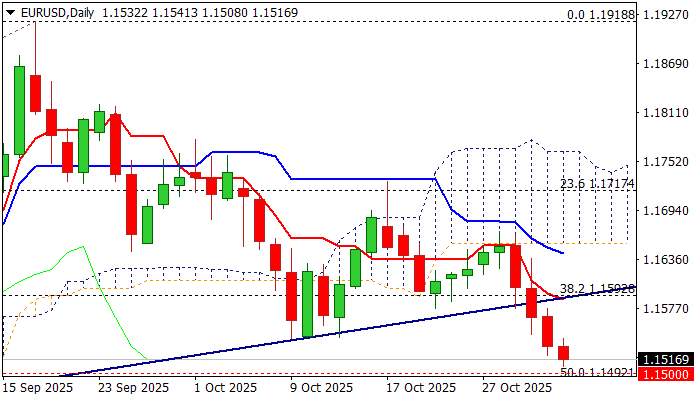

EURUSD – bears hold grip, consolidation likely to precede push through important 1.1500 support zone

The Euro continues to trend lower and pressures 1.1500 support zone (round-figure / 50% retracement of 1.1065/1.1918 rally) in early Monday’s trading.

The bear-leg that emerged from a double bull-trap at the base of thick daily cloud, extends into fourth consecutive day.

Break below former higher base (1.1542) completed bearish failure swing pattern on daily chart that adds to bearish near-term outlook.

The notion is supported by strengthening bearish momentum and diverging daily Tenkan / Kijun-sen in bearish setup and converging 55/100DMA’s in attempt to create a bear-cross.

Break of 1.1500 zone to spark further weakness and expose 1.1400 support zone (Fibo 61.8% / higher base of July 30 / Aug 1).

Meanwhile, bears may face headwinds at 1.1500 zone due to oversold conditions and position for fresh push lower, with extended upticks to be capped under 1.1590 zone (broken trendline support / broken Fibo 61.8% / falling 10DMA).

Stronger dollar on the recent Fed’s hawkish cut, which eased bets for December rate cut, continue to pressure Euro, as the US central bank is likely to miss again key report from the labor sector due to prolonged government closure.

This may keep the Fed on hold until getting clearer picture of the situation in the sector, as the already expressed concerns about inflation which still hold well above the target.

Res: 1.1542; 1.1590; 1.1611; 1.1640

Sup: 1.1500; 1.1446; 1.1391; 1.1322