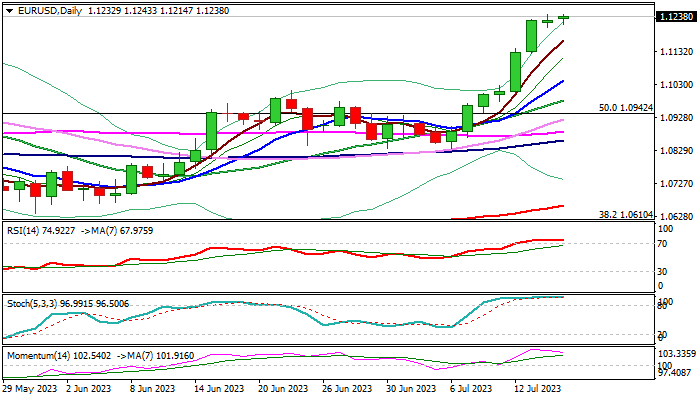

EURUSD – bulls hold grip but strongly overbought conditions warn

The Euro remains at the front foot in early Monday trading, although strongly overbought daily studies and Friday’s Doji candle, suggest that the uptrend may pause.

Strong bullish acceleration in past seven days also faced headwinds from 100MMA (1.1254) on approach to pivotal Fibo barrier at 1.1270 (61.8% retracement of 1.2349/0.9535 downtrend).

Near-term action is underpinned by last week’s large bullish candle (the pair was up 2.4%, the biggest weekly advance since early Nov 2022) but fading bullish momentum and overbought stochastic and RSI require caution.

We will be looking for fresh signal on today’s close, with repeated Doji to contribute to scenario of consolidation / mild correction, while violation of 1.1274 Fibo barrier would further strengthen near-term structure and add to the upside potential.

Broken 200WMA offers initial support at 1.1183, with former top (1.1095) reverted to solid support, which should ideally contain dips and guard lower pivot at 1.1041 (rising 10DMA).

Res: 1.1254; 1.1274; 1.1325; 1.1380

Sup: 1.1204; 1.1183; 1.1113; 1.1095