EURUSD – bulls take a pause ahead of ECB

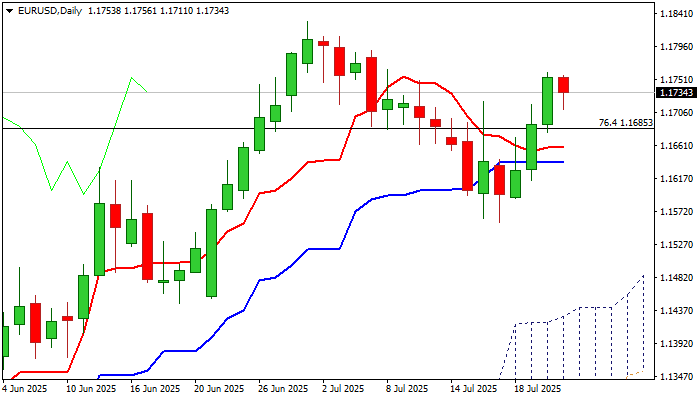

EURUSD eases from new two-week high (1.1760) on Wednesday, as traders reacted to overbought conditions and opted for partial profit taking after steep three-day rally.

Dips were so far shallow (contained by 20DMA at 1.1708), keeping intact more significant support at 1.1685 (broken Fibo 76.4% of 2021/2022 1.2349/0.9535 downtrend).

The pair holds in rather quiet mode on Wednesday as markets await decision from ECB’s policy meeting on Thursday.

The central bank is widely expected to keep the policy unchanged after a series of rate cuts that could be supportive factor for the single currency, along with weakening dollar.

Near-term action is likely to remain biased higher in scenario of limited dips (ideally to stay above broken Fibo at 1.1685), as technical picture on daily chart is predominantly bullish, although 14-d momentum is moving along the centreline and lacks clearer signal.

Res: 1.1760; 1.1800; 1.1830; 1.1909

Sup: 1.1760; 1.1685; 1.1658; 1.1615