EURUSD extends steep fall into third day, eyes Fed’s decision for fresh signals

EURUSD extends the sharp fall into third consecutive day, losing about 2.5% since Monday opening.

Fresh strength of dollar on very favorable for the US trade deal with EU and much stronger than expected US economic growth in the second quarter, keep the single currency under increased pressure.

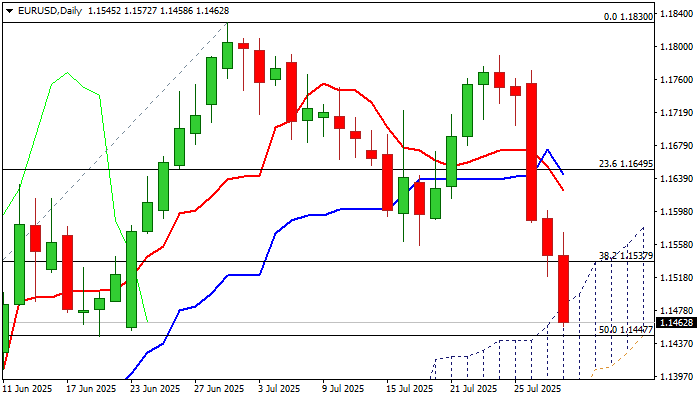

Significantly weaker technical picture on daily chart following break of trendline support, completion of bearish failure swing pattern and the latest violation of the top of ascending daily Ichimoku cloud (1.1485) which underpinned the larger uptrend since early March, contribute to strong bearish signals on daily chart..

Fresh bearish signals are also developing on weekly and monthly charts as the pair is on track for the biggest weekly drop since mid-September 2022 and formation of bearish engulfing pattern and also for the first monthly loss in seven months.

Daily close below broken Fibo support at 1.1537 (38.2% retracement of 1.1065/1.1830) is the minimum requirement for fresh bears to remain fully in play, with penetration of daily cloud and break below 1.1447 (50% retracement) would further weaken near term structure and expose next key levels at 1.1357 (Fibo 61.8% / daily cloud base).

Strengthening negative momentum on daily chart and Tenkan/Kijun-sen bear-cross add to negative near term outlook.

Fed’s verdict (due later today) will be next top event, with wide expectations to keep rates on hold and more focus on comments about the central bank’s steps in the near future.

The Euro will extend its current free fall if the Fed keeps its hawkish stance, while the dollar may come under pressure if Powell & Co soften their interest rate rhetoric.

Res: 1.1485; 1.1537; 1.1572; 1.1623

Sup: 1.1447; 1.1371; 1.1357; 1.1245