EURUSD hits new 2025 highs as expectations for dovish Fed continue to fuel demand

EURUSD continues to benefit from weakening dollar and accelerated gains on Tuesday, to hit new 2025 highs, after showing a minor and short-lived negative reaction to upbeat US economic data today (retail sales and industrial production).

Positive sentiment was fuelled by expectations that the Fed would keep dovish stance after widely expected rate cut on Wednesday.

The US policymakers have already signalled that support to weakening labor market through policy easing has priority against still elevated inflation, which they see as transitory, with current monetary policy being restrictive enough to curb inflationary pressures.

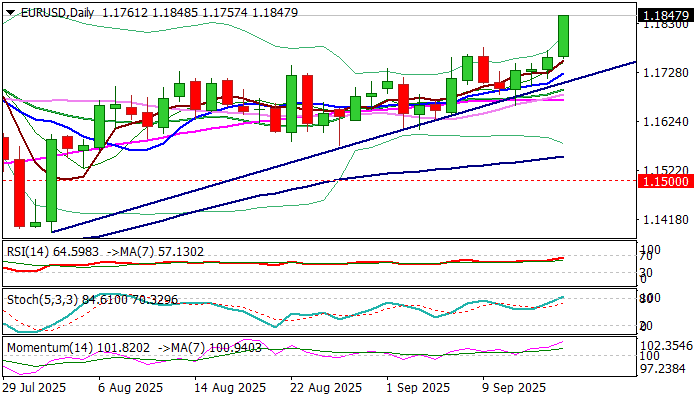

Firmly bullish daily studies (strengthening positive momentum / MAs in full bullish setup) add to positive outlook.

Violation of former 2025 peak (1.1830) is generating initial signal of bullish continuation of larger uptrend from 2025 low (1.0177) which was paused for 1.1830/1.1391 (July 1 / Aug 1 correction).

Sustained break above 1.1830 to confirm the signal and expose targets at 1.1935 (Fibo 123.6% projection), 1.2000 (psychological / Fibo 138.2%) and 1.2019 (bear-trendline connecting tops of 2018 and 2021).

Res: 1.1900; 1.1935; 1.2000; 1.2019

Sup: 1.1830; 1.1780; 1.1757; 1.1726