EURUSD – larger bulls remain in play ahead of key economic events

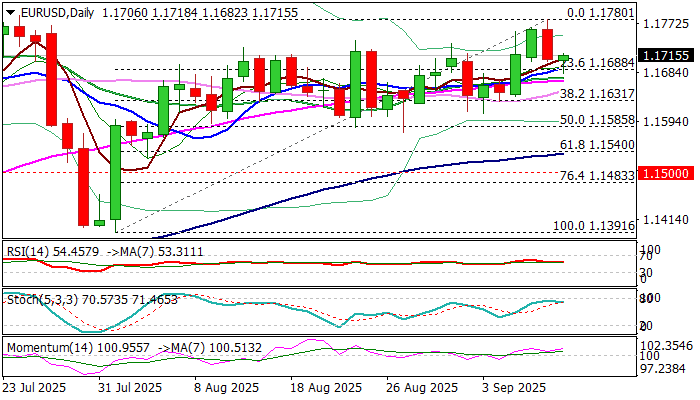

EURUSD extended pullback on early Wednesday, following nearly 0.5% drop on Tuesday, but fresh bears were so far limited despite initial negative signal on formation of bearish engulfing pattern on daily chart.

Initial Fibo support at 1.1690 (23.6% of 1.1391/1.1780) reinforced by 10DMA provides solid support which contained today’s dips.

Technical picture on daily chart is predominantly bullish, though early next week’s daily cloud twist would be magnetic and attract bears for probe through 1.1690 and attack at next key levels at 1.1630/10 zone (Fibo 38.2% / Sep 2,3 higher lows.

Traders eye key economic events, ECB interest rate decision and US Aug CPI, due on Thursday.

The European Central Bank is expected to keep rates on hold at 2%, as Eurozone consumer prices are steady around the ECB’s target.

Fed meets next week, and it is widely expected to deliver the first rate cut (25 basis points), with strong weakening in the US labor sector increasing pressure for policy easing, as US policymakers see still elevated inflation as temporary, with current restrictive monetary policy expected to absorb negative impacts.

Res: 1.1736; 1.1780; 1.1800; 1.1830

Sup: 1.1690; 1.1630; 1.1610; 1.1574