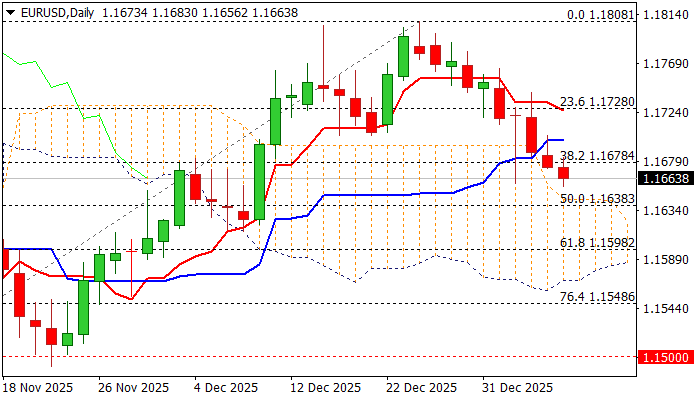

EURUSD – next week’s daily cloud twist to attract for further weakness

The Euro extends bear-leg from 1.1808 (dec 24 peak, where larger rally was capped by Fibo 76.4% of 1.1918/1.1468) and attempts to establish below important Fibo level at 1.1678 (38.2% of 1.1468/1.1808 rally).

The pair is on track for the second consecutive daily close below this level that would verify fresh bearish signal.

The price continues to trend lower along with the top of thinning daily cloud which will twist late next week and remain magnetic.

Bears eye targets at 1.1638 (Fibo 50% / 55DMA) and 1.1623/15 (cloud twist / daily higher base of Dec 8/9), though face increased headwinds at 100DMA support (1.1663), where Monday’s attack was strongly rejected.

Oversold stochastic contributes to scenario of consolidation preceding fresh weakness, as daily studies are bearishly aligned (double-top / negative momentum / 10/20; 5/10; 5/20 and 5/30DMA bear-cross).

Potential upticks should be ideally capped under 1.1700 (former higher base) while sustained break above 1.1730 zone (broken Fibo 23.6% / 20/10DMA’s) would sideline bears.

Res: 1.1683; 1.1800; 1.1730; 1.1765

Sup: 1.1638; 1.1615; 1.1598; 1.1562