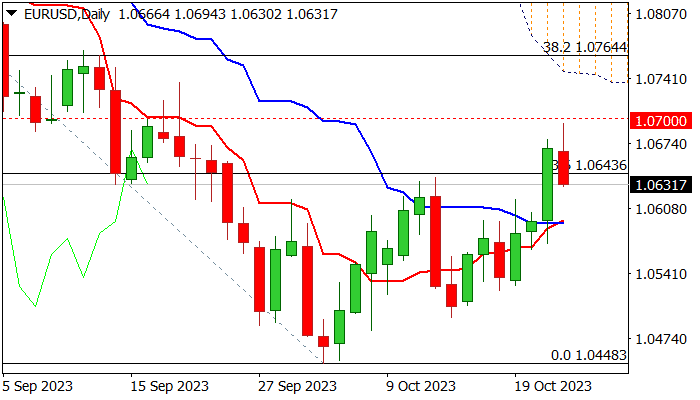

EURUSD – recovery loses traction after weak PMI’s hurt fresh bullish sentiment

EURUSD edged lower on Tuesday after three-day recovery acceleration faced increased headwinds on approach to psychological 1.0700 barrier, reinforced by falling 55DMA.

Recently strength started to lose traction after weaker than expected EU / German PMI’s in October added to concerns about economic growth and started to deflate risk appetite.

Current pullback is supported by fading bullish momentum and overbought stochastic on daily chart, but would mark a healthy correction of two-legged recovery from 1.0448 (2023 low) if dips find ground above 1.0600 zone, where daily Tenkan-sen and Kijun-sen are forming a bull-cross.

Reversal above 1.06 handle would keep bulls in play for renewed attack at 1.07 pivot, break of which to signal bullish continuation and expose next key barriers at 1.0746/64 (Fibo 38.2% of 1.1275/1.0448 downtrend / base of falling thick daily Ichimoku cloud.

Caution on loss of 1.0600 support zone, which would risk further weakness and shift near-term focus to the downside.

Res: 1.0643; 1.0694; 1.0746; 1.0764

Sup: 1.0616; 1.0595; 1.0565; 1.0495