EURUSD rises to 5-week high as dollar suffers from fresh tariff threats

EURUSD hit the highest in over five weeks on Monday, inflated by weaker dollar on the latest threats of doubling import duties on steel and aluminium.

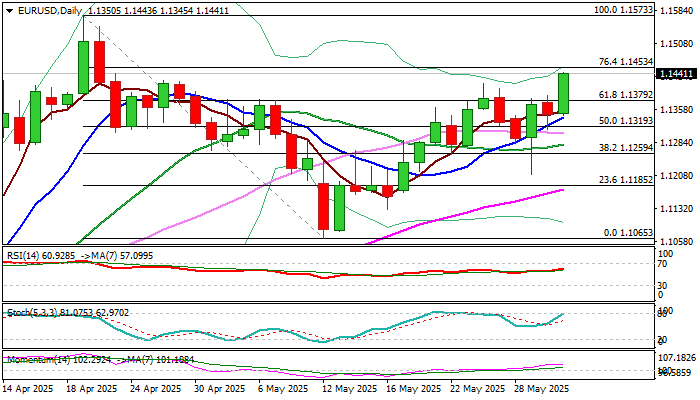

The pair gained around 0.8% by the mid-US session and pressure strong resistance at 1.1453 (Fibo 76.4% of 1.1573/1.1065, reinforced by the upper 20-d Bollinger band.

Bulls may face increased headwinds here as bullish momentum started to fade and daily stochastic cracks the border of overbought territory.

Overall picture, however, remains positive with near term action being underpinned by thick daily cloud and MA’s back to full bullish configuration, suggesting that bulls may take a breather for consolidation before resuming.

Broken Fibo 61.8% (1.1379) reverted to solid support which should ideally hold, although bullish near term bias expected while the price stays above rising daily Tenkan-sen (1.1327).

Firm break of 1.1453 to open way for retest of 2025 peak (1.1573).

Res: 1.1453; 1.1500; 1.1547; 1.1573

Sup: 1.1418; 1.1379; 1.1355; 1.1327