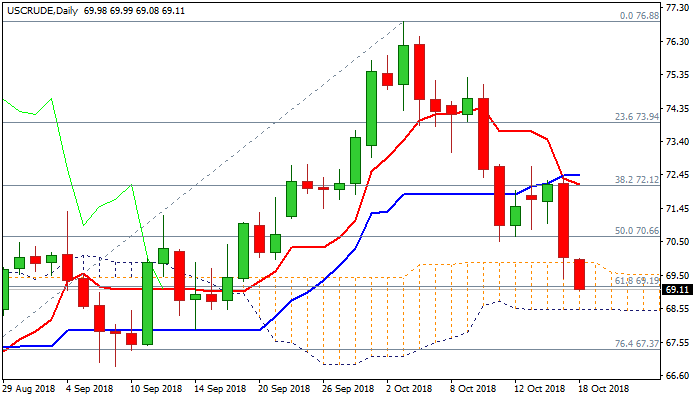

Extension of Wed’s strong fall eyes daily cloud base

WTI oil holds firm negative tone on Thursday and extends previous day’s strong losses, when crude was down 3%.

Stronger than expected build in US crude inventories (6.49 mln bls vs expected 1.6 mln bls build) sparked strong bearish acceleration which dipped to one-month low at $69.42 but failed to close below psychological $70 support and daily cloud top ($69.89).

Fresh weakness today penetrated daily cloud and cracked pivotal support at $69.15 (Fibo 61.8% of $64.43/$76.88 ascend), generating bearish signal for stretch towards next pivot at $68.51 (daily cloud base).

Formation of 10/20SMA bear-cross reinforces bearish setup of daily MA’s, with strengthening bearish momentum, confirming strong bearish tone of daily techs.

Strong bearish sentiment remains unaffected from persisting tensions over the death of Saudi journalist, which could escalate as Saudi Arabia threatened of retaliation on strong accusations from the US and other big world powers.

Res: 69.46; 69.89; 70.00; 70.49

Sup: 68.51; 67.93; 67.37; 66.85