Fresh bulls face strong headwinds from daily cloud; fresh signals expected from UK CPI and Brexit news

Cable trades returns below 1.30 handle in early European trading but still holding positive tone following Tuesday’s strong UK earnings data and renewed Brexit optimism.

The UK and EU agreed a preliminary text of Brexit deal, which could help the UK to avoid chaotic scenario on no-deal divorce.

The document hasn’t been published yet and there is still long way towards its implementation, as the document needs to get an approval from the parliament.

UK PM May’s senior members of the cabinet are likely to back the agreement, but it may lack support from the opposition parties, which could further increase volatility.

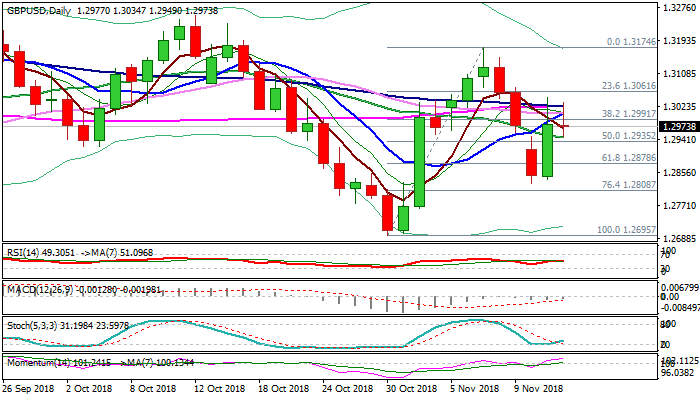

Strong rally on Tuesday generated bullish signal on formation of bullish outside day pattern, but failed to confirm continuation after bulls penetrated daily cloud but were strongly rejected on approach to cloud top (1.3055), with subsequent pullback resulting in daily close just below cloud base (1.2980).

Similar scenario was seen in Asian / early European trading, as thick daily cloud (1.2980/1.3046) proves to be strong obstacle, reinforced by plethora of daily MA’s within 1.3000/24 zone).

Daily techs are mixed (MA’s remain in bearish configuration while momentum continues to strengthen bounces from oversold zone border.

The pair is looking for a catalyst to provide fresh direction signal after bulls showed strong signs of fatigue.

UK CPI data could boost pound on upbeat Oct figures (Oct CPI m/m 0.2% f/c vs 0.1% prev / Oct CPI y/y 2.5% f/c vs 2.4% prev), however, focus remains on news from Brexit talks, which remain key driver of the British pound.

The pair could jump towards last week’s peak at 1.3174 if new proposal passes the parliament and gets supported by all political factors in the UK, while negative scenario on repeated talks’ stall could risk fresh weakness towards strong supports in 1.2700 zone.

Res: 1.2980; 1.3000; 1.3046; 1.3092

Sup: 1.2949; 1.2935; 1.2883; 1.2838