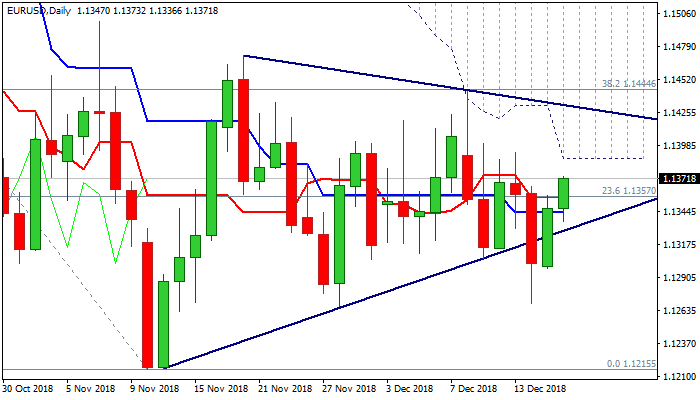

Fresh bulls may face strong headwinds from thick falling daily cloud

The Euro maintains positive tone in early Tuesday’s trading and probes above converged 10;20;30SMA’s and Monday’s high at 1.1354/58 zone.

Bullish near-term bias on strong downside rejection last Friday (triple-bottom is forming at 1.1270 zone) is also supported by expectations for dovish tone from Fed on Wednesday.

Fresh bulls are lacking momentum and may struggle at strong barriers at 1.1388 (base of thick daily cloud) and 1.1401 (falling 55SMA).

Daily cloud marks strong resistance which already capped recovery attempts and sustained break here would generate bullish signal for test of next key barrier at 1.1444 (Fibo 38.2% of 1.1815/1.1215 / 10 Dec spike high).

Scenario could be supported by softer tone from the Fed (the US central bank already signaled slowing the pace of rate hikes in 2019), with reversal signal to be generated on close above 1.1444 pivot.

Conversely, repeated rejection under daily cloud would risk fresh weakness and keep the downside vulnerable.

Key support lays at 1.1270 zone (lows of 15/28 Nov; 14 Dec) and sustained break here would generate bearish signal.

German Ifo data is the key event in the European session today. German business climate is expected to slow (101.8 f/c vs 102 prev) and could add to negative near-term signals on weaker than expected release.

Res: 1.1376; 1.1388; 1.1401; 1.1444

Sup: 1.1354; 1.1336; 1.1298; 1.1270