GBPUSD continues to pressure daily cloud base following limited positive impact from higher than expected inflation

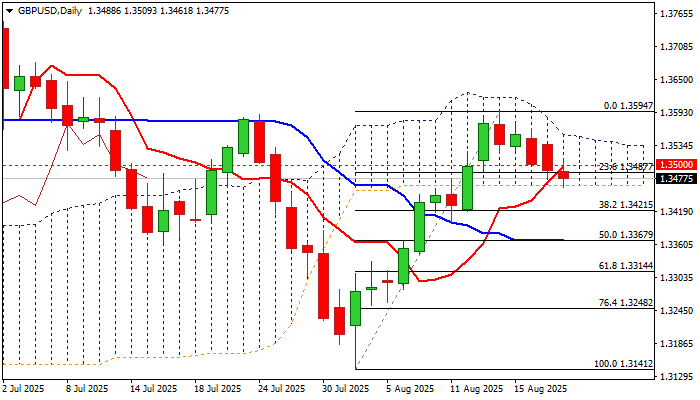

Cable edged higher on Wednesday after testing next key support provided by daily cloud base (1.3464), following break below psychological 1.3500 level (reinforced by daily Tenkan-sen) previous day.

Pound was lifted by disappointing UK July inflation data which further darkened outlook as Britain’s inflation is the highest and fastest growing among G7 economies.

In addition, economic growth remains weak that makes the position of UK policymakers more difficult, with bets about rate cut by the end of the year, fading after today’s data.

However, stronger than expected rise in consumer prices and weaker dollar, were unable to significantly lift pound, as traders remain very cautious about growing threats of stagflation (elevated inflation, weak economy, although the labor sector is still resilient) that may sour sentiment and limit gains.

Daily technical studies are still in predominantly positive configuration, with slight bullish bias expected to stay alive while the price holds above daily cloud base, though sustained break above 1.3500 level will be needed to boost initial positive signal and expose pivotal barrier at 1.3554 (daily cloud top).

Strong positive momentum and multiple MA bull-crosses continue to underpin the price, but risk of further weakness remains in play, due to weakening sentiment.

In the negative scenario on firm break of cloud base, the price would target 1.3421 (Fibo 38.2% of 1.3141/1.3594) and 1.3400 (100DMA) with 1.3367 (50% retracement) expected to come in focus on stronger acceleration.

Res: 1.3500; 1.3554; 1.3564; 1.3594

Sup: 1.3464; 1.3421; 1.3400; 1.3367