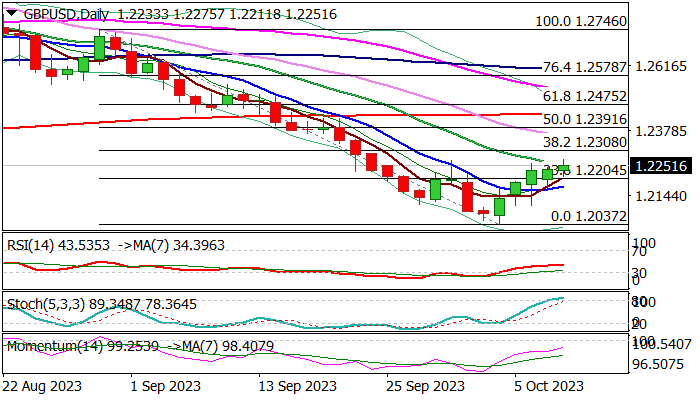

GBPUSD – fresh bulls hold grip but need more work to signal reversal

Cable rose to the highest in nearly two weeks on Tuesday, keeping in play near-term recovery which extends into fifth straight day.

Softer tone in the most recent comments from US policymakers, added to fresh but still limited risk appetite, keeping the pound underpinned for now.

Bulls probe through falling 20DMA (1.2252) with close above here to strengthen near-term structure for attack at pivotal Fibo barrier at 1.2308 (38.2% retracement of 1.2746/1.2037 downleg), violation of which would generate initial reversal signal.

On the other hand, caution is still required, as daily studies are still predominantly in bearish configuration (MA’s / momentum) and also turning overbought, warning that recovery may start running out of steam.

Dip-buying remains favored above 10DMA (1.2174) but expect the downside to be vulnerable while 20DMA caps.

Res: 1.2252; 1.2275; 1.2308; 1.2355

Sup: 1.2204; 1.2174; 1.2105; 1.2052