GBPUSD – limited gains after BOE kept rates unchanged

Cable jumped above 1.31 mark after BOE left rates unchanged as widely expected, but trimmed gains on signals that the central bank could cut in December policy meeting, which comes after government’s budget (Nov 26) and releases of inflation reports for October and November, that would provide more information to policymakers.

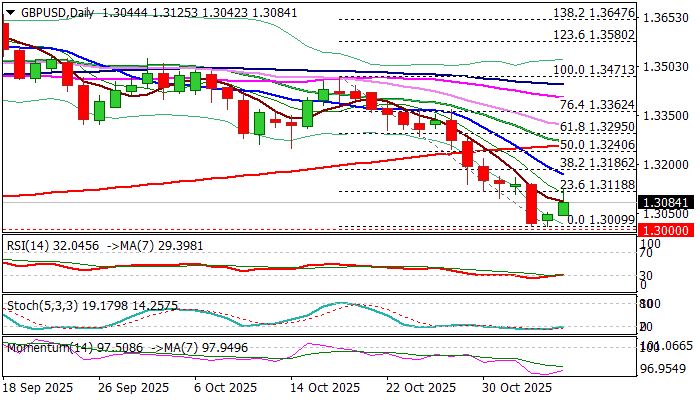

Bounce from multi-month lows (1.3009 double-bottom, after broader bears faced strong headwinds on approach to psychological 1.30 support), extended into second straight day, but reached so far only the first barrier at 1.3118 (Fibo 23.6% of 1.3471/1.3009), leaving more significant barriers at 1.3170/86, out of reach.

This raise worries about limited recovery, before bears regain control again for fresh attack at 1.30 pivot.

Technical picture on daily chart remains bearish, with recent formation of 10/200DMA death cross and converging 20/200DMA’s on track to form another one, adding to negative outlook, as 14-d momentum (although turning up) is still deeply in negative territory, although RSI emerging from oversold zone, partially offsetting negative signal.

Extended upticks should be capped under 1.3186 Fibo barrier, to mark a healthy correction before larger downtrend resumes.

Alternatively, stronger acceleration higher and violation of 1.3240/60 (50% retracement / 200DMA) would sideline bears and open way for potential stronger recovery.

Res: 1.3143; 1.3186;1.3218; 1.3240

Sup: 1.3042; 1.3000; 1.2948; 1.2810