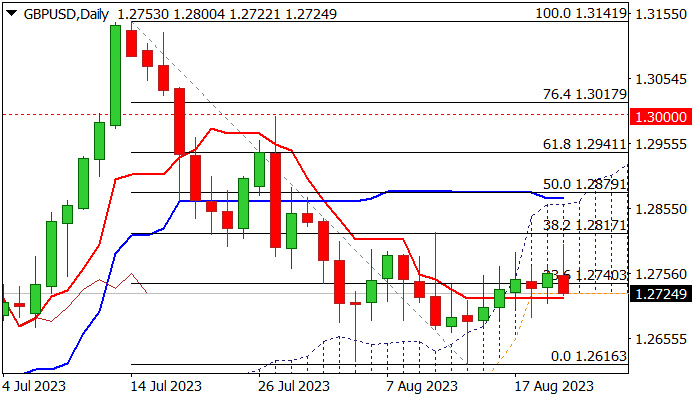

GBPUSD – risk of recovery stall on close below cloud base

Cable continues to move within thickening daily cloud and hit new marginally higher two-week high on Tuesday, but quick pullback warns that bulls might be losing traction.

Near-term action is expected to keep slight bullish bias while holding above cloud base (1.2725) reinforced by daily Tenkan-sen, however, today’s action is so far shaped in red candle with long upper shadow which signals strong offers and weighs on recovery.

The downside is expected to remain vulnerable while the price stays under pivotal Fibo barrier at 1.2817 (38.2% of 1.3141/1.2616), violation of which would generate fresh bullish signal for extension towards key resistances at 1.2860/71 (daily cloud top / Kijun-sen).

Conversely, close below cloud top would generate initial signal of recovery stall and shift near-term focus lower.

Res: 1.2800; 1.2817; 1.2879; 1.2941

Sup: 1.2717; 1.2708; 1.2686; 1.2659