Gold advances further on Powell’s dovish stance

Gold price rose further in early Tuesday following more dovish tones from Fed Powell in his speech on Monday, which contributes to growing expectations that the Fed may soon decide to start cutting interest rates.

Powell pointed to the recent inflation data which boost optimism that inflation remains on track towards 2% target, fueling hopes for eventual start of policy easing.

Markets focus on release of US retail sales, due later today (June f/c -0.3% vs May 0.1%) with June numbers at / below expectations to add to rate cut narrative and further boost metal’s price.

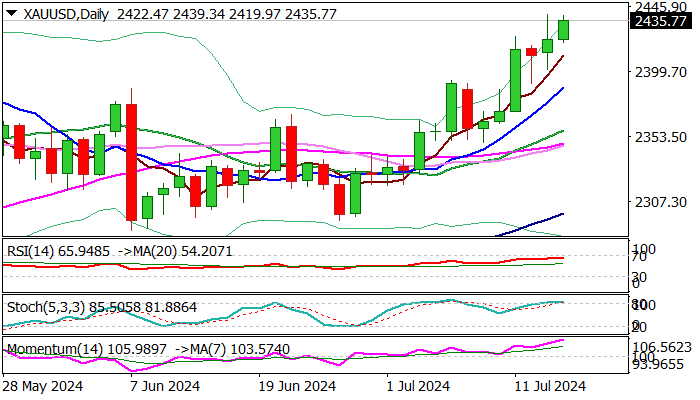

Fresh rise came closer to new record high ($2450), though headwinds at this zone cannot be ruled out, due to significance of resistance and overbought daily studies, with limited dips (expected in unchanged positive environment for gold) to offer better levels to re-join bullish market.

Firm break of $2450 pivot to expose initial target at $2500, with stronger acceleration higher to be anticipated on break here.

Rising 10DMA ($2388) should contain and keep larger bulls intact.

Res: 2450; 2500; 2515; 2551

Sup: 2420; 2400; 2388; 2366