GOLD – bears tighten grip and probe again into daily cloud

Gold remains in red for the second consecutive day, pressured by stronger dollar on risk aversion as uncertainty over US tariffs rises.

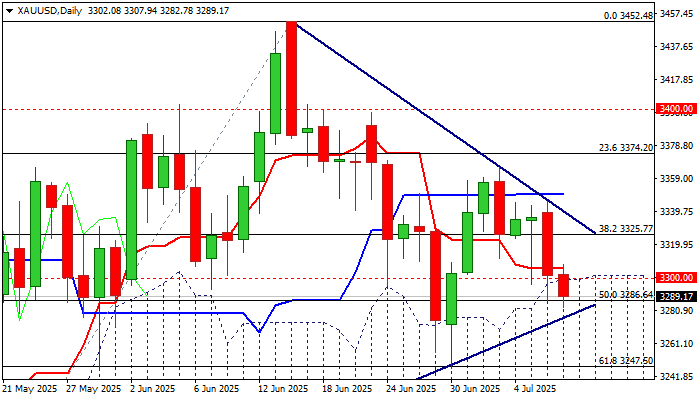

Bears probe again through pivotal support at $3300 (psychological / rising daily cloud top) in attempts to sustain break lower, after cloud contained several attacks recently.

Today’s action so far hold in the cloud, as bears cracked 50% retracement of $3120/$3452 ($3286) and eye next significant support at $3277 (triangle support line).

Daily studies are weak (Tenkan/Kijun-sen in bearish setup / negative momentum is strengthening) and supportive for further easing, with loss of $3277 trendline support to risk attack at key supports at $3247 (Jun 30 higher low/ Fibo 61.8%) and $3228 (daily cloud base).

Conversely, another failure to register daily close within the cloud, would ease immediate downside threats, but regain of $3225/36 (broken Fibo 38.2% / upper triangle boundary) will be required to sideline near-term bears and shift focus higher.

Fed minutes (due later today) are in focus for more details about Fed’s short-term rate outlook.

Res: 3300; 3308; 3325; 3338

Sup: 3277; 3247; 3228; 3205