Gold bounces from one-month low but recovery still hold below initial barriers

Gold bounced from one-month low ($3247) on Monday, lifted by weaker dollar and partial profit-taking from 5% drop in past two weeks.

The yellow metal showed limited positive reaction on recent war between Israel and Iran but fell two full figures on announcement of ceasefire and signals of US-China trade deal, which contributed to strong drop in safe-haven demand.

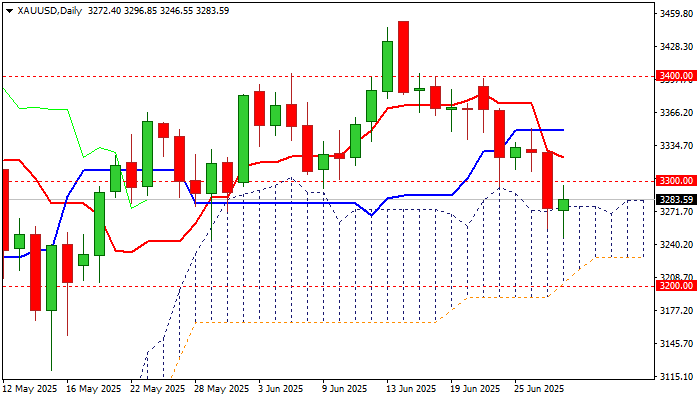

Bears faced strong headwinds from thick daily Ichimoku cloud (cloud top lays at $3276) and has repeatedly contained dips (today / Friday) highlighting the significance of support.

However, recovery still lacks strength to clear first significant barriers at $3300 zone (14-d momentum is in negative territory / MA’s still in full bearish setup) that keeps the downside vulnerable.

Near-term action may hold in more quiet mode as markets await releases of key US labor reports (JOLTS / ADP / NFP) this week, which are expected to provide a fresh update about the situation in US labor sector and subsequently contribute to Fed’s rate decisions.

The latest positive signals from US-China trade deal may ease pressure, although tariffs are likely to remain the main obstacle, as the US central bank sees increased risk of fresh rise in consumer prices if Trump’s administration implements tariffs.

Bullish scenario – initial positive signal on clear break of $3300 zone, which will need verification on lift above $3325 (Fibo 38.2% of $3452/$3246 descend) and open way for possible stronger recovery.

Bearish scenario – the downside is expected to remain at risk if recovery repeatedly fails to clear $3300 zone, with repeated penetration of daily cloud and violation of recent low ($3247, also Fibo 61.8% of $3120/$3452) to risk deeper drop towards $3200 (psychological / Fibo 76.4%).

Res: 3300; 3325; 3350; 3373

Sup: 3247; 3222; 3200; 3168